Connecting restaurant industry trends to your business growth and foodservice reach in 2021

This article sheds insights into what restaurant operators can learn from key restaurant industry trends in consumer behavior and foodservice operations in 2021 to keep their restaurants accessible to consumers and secure the bottom line.

The 5 trends we have focused on below cover pertinent changes in dining service, payment and ordering options, and customer preferences that operators ought to keep an eye out for while running their restaurants in 2021.

How can your restaurant look forward to growth and stability in 2021?

2020 brought several changes to the way hospitality businesses around the world were able to run and serve guests. For restaurants, staying resilient amid the challenges of doing business under pandemic restrictions meant quickly adapting to new customer dining preferences; making strategic changes to operations, and adding resources to expand service offerings that drove sales.

For restaurants in 2021, the key to maintaining competitive advantage and profitability comes down to how closely aligned their business models are to restaurant industry trends (equipping operations with technology and practices to thrive) and emerging consumer preferences (how consumers will choose to dine this year).

Consumer dining behavior trends to look out for in 2021

- Off-premises dining will continue to stay popular among consumers and dominate restaurant sales

For the most part, due to COVID restrictions on dine-in last year, consumers accessed food from restaurants through off-premise dining options, like curbside delivery, online ordering, take out, and contactless delivery. In 2020, 53% of all adults said that purchasing food through take-out and delivery is essential to the way they live1.

As consumers have adapted to conditions, restaurant dining now is more about convenience, comfort, and most importantly low risk. Off-premise dining offers all these qualities for diners that consider restaurants a part of their lifestyle, especially the affordance of minimal risk. 44% of consumers consider getting carryout/takeout and food delivered to be not risky3.

Last year, 71% of operators spanning all restaurant segments stated that off-premise dining represented a larger share of their revenue than before COVID restrictions1. Based on that fact alone, operators can see the value in extending off-premise options to consumers, but they would be remiss in thinking that this trend is strictly bound to the pandemic. In 2019, off-premise sales represented nearly 60% of restaurant sales through all platforms6. The pandemic has only accelerated consumer comfort with using customer-facing restaurant technology like online apps, for example.

Regardless of whether you are an operator looking to introduce off-premise offerings on the back of its success in driving sales during COVID restrictions, or are looking to expand your current off-premise model to eventually scale business; focusing on the most essential offerings will ensure your business is well prepared to take advantage of the uptick in off-premise dining interest we will see throughout 2021 and beyond.

- QR code menus - 1 in 5 customers say the option of accessing the menu on their phone through a QR code would make them more likely to choose one restaurant over another during the next few months1.

- Contactless and Mobile Payments - Baby boomers and Gen Xs are much less likely to have tried contactless payment, but Millennials and Gen Zs will continue to use contactless payment options even once restrictions are lifted. 43% of millennials were already using contactless payment before the pandemic and 25% of Gen Zs tried it for the first-time during restrictions last year1.

- Online Ordering (native or third-party) - 50% of diners say that the availability of online ordering would influence their choice of one restaurant over another1. 79% of Baby boomers and 65% of Gen Xs are most likely to say they prefer to order directly through the restaurant for delivery. 44% of Gen Zs and 37% of millennials say that they will continue using third-party online ordering apps after restrictions lift2.

- Delivery and Takeout - 6 in 10 adults are more likely to get food delivered than before the outbreak, which is higher among millennials with 71% agreeing to this1.

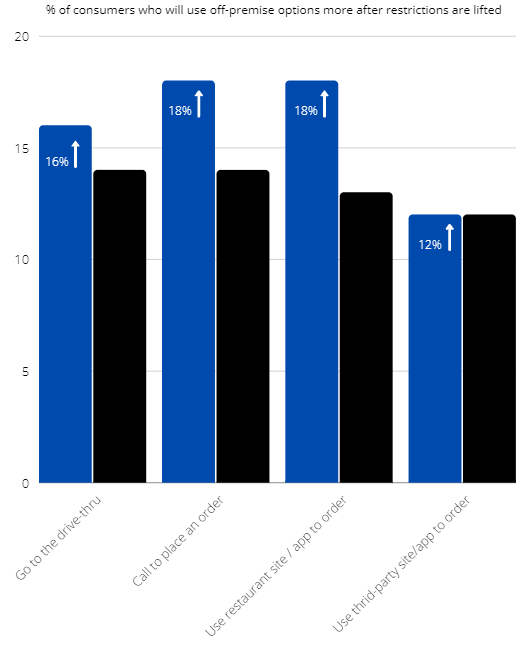

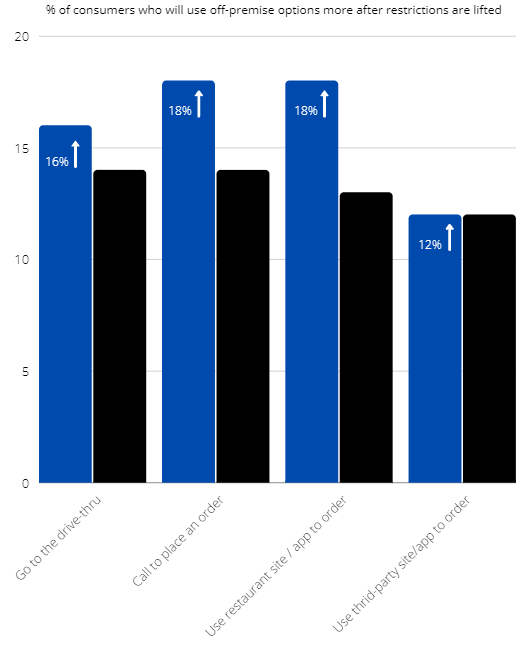

As restrictions start to wane eventually, it’s reported that customers will use the following off-premise options more than they did pre-COVID2:

- Drive-throughs by 18%

- Call restaurants to place an order by 18%

- Use restaurant app to order by 18%

- Use third-party delivery apps by 12%

- Restaurant diners are eager to return to restaurant dining rooms but will prioritize safety

There is a growing pent-up demand among customers to dine-in at restaurants with many anticipating the day it becomes safe to do so. 67% of adults say they are not eating on the premises at a restaurant as much as they would like – with baby boomers (76%) and Gen Xs (65%) feeling the biggest pinch in this regard, followed by millennials (60%) and Gen Zs (56%)1.

Restaurants can expect diners to start returning to their dining rooms in the second half of 2021 as COVID vaccination rollouts start to ramp up. Consumers are excited to get back into dining rooms as soon as a new sense of normalcy is established, which for 40% of consumers means a vaccine is widely available3.

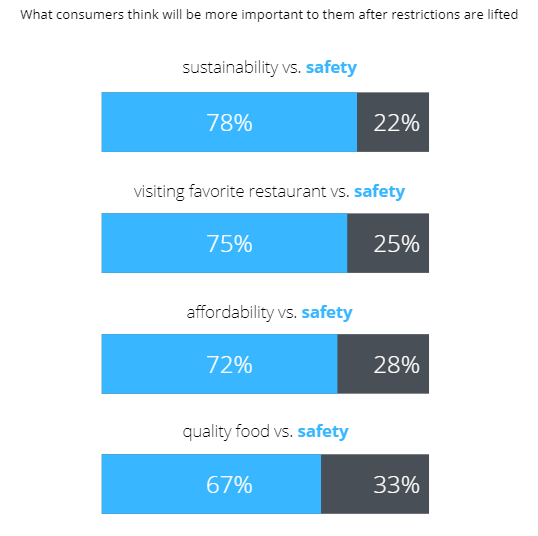

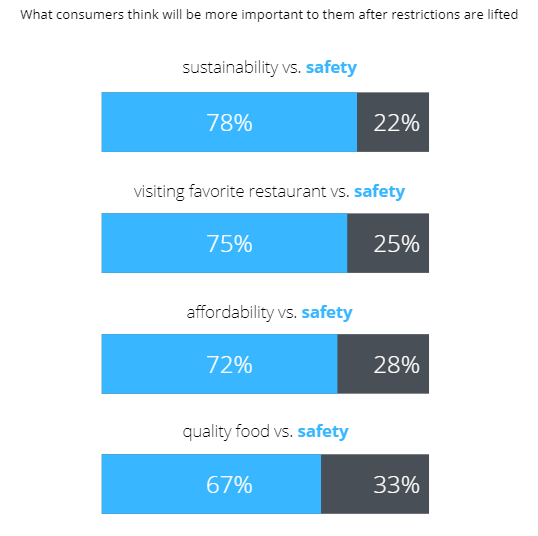

When preparing for restaurant re-opening for dine-in service, being knowledgeable about what customers expect is important to create a good impression and attract repeat business. Customers have come to expect restaurants to strictly adhere to pandemic safety protocols. 72% of customers rank safety over affordability and 67% rank safety over quality food2, which goes to show that safety reigns supreme now when considering meeting guest expectations and attracting business at your restaurants moving forward.

When it comes to what safety precautions are more important to diners it is safe to assume that more is better, but a few practices are seen less as a “good to have” and more of a requirement.

For example, 81% of diners now require operators to regularly/visibly wipe down tables, kiosks, other things people touch; 88% require other customers to maintain six feet or more of social distance; 45% require operators to enable mobile ordering/contactless payment. Other safety precautions worth considering are – getting rid of physical menus (60% of consumers support this) and eliminating communal seating (67% consumer support)3.

A part of keeping dine-in operations COVID safe requires planning floor operations in a way that limits server-customer interactions wherever possible without compromising the dining experience.

Having your staff equipped with the right kind of safety gear during service also falls under the purview of what diners expect in terms of safety. Close to 50% of consumers that dined at a restaurant during the pandemic were served by staff wearing gloves, 47% said servers wore masks when handing them food, and 33% were offered contactless payment options2.

Additionally, adding Mobile POS (Point of sales) technology like tablets can help restaurants limit the need for multiple staff members to use one fixed POS terminal. Mobile POS system solutions promote a more contactless dine-in service at restaurants, making them safer.

Restaurant operational trends to consider for 2021

- Accelerated technology investments will help restaurants respond to changes in dining preferences and scale operations

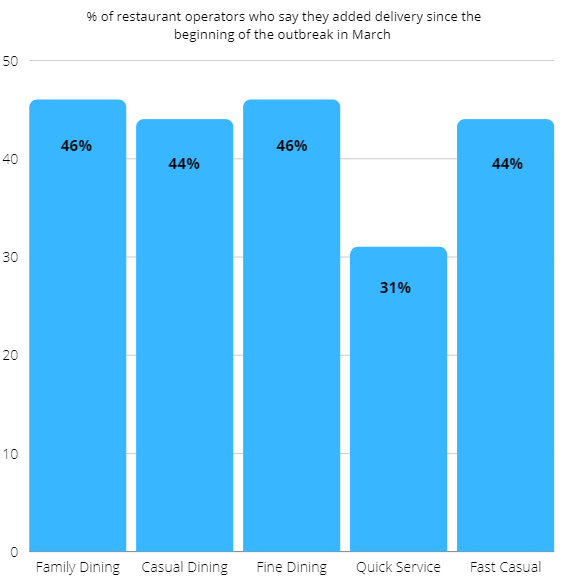

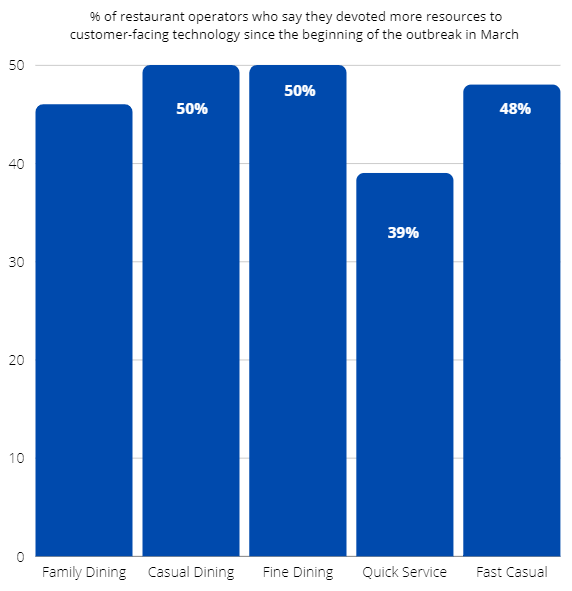

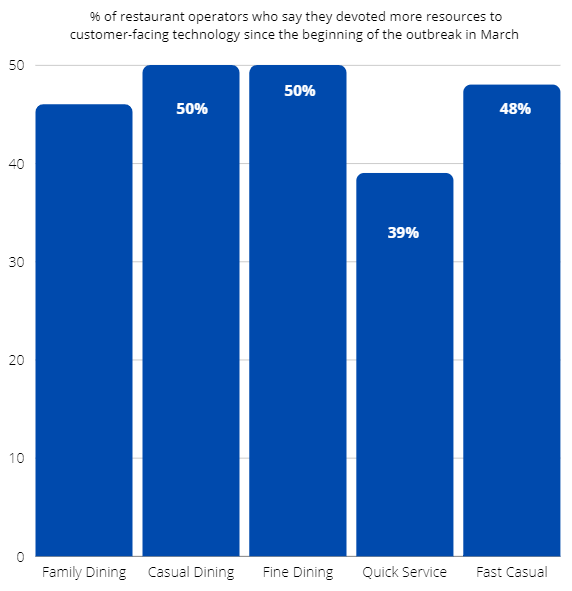

Restaurants were forced to adapt to an almost overnight shift away from on-premise dining and towards off-premise dining in March. 50% of fine dining, 50% of casual dining, and 46% of family dining restaurants say they devoted more resources to customer-facing technology like online or in-app ordering, mobile payment, and delivery management since March1.

Guided by the same changes to business operations and consumer dining behavior last year, Operators will look to accelerate key technology investments to optimize the business and improve restaurant reach locally in 2021. 71% of foodservice operators said the pandemic increased their sense of urgency to adopt transformational technologies, and believe digital transformation is very important to maintain business agility4.

When it comes to growing restaurant reach in 2021, off-premise technology investments in the form of POS upgrades and integrations that enable contactless, mobile, and online payment options like tap-to-pay and mobile wallet, and online ordering and delivery through third-party delivery apps, will continue to be a priority for operators in 2021.

68% of operators state enabling new payment options (e-wallet, tap-to-pay/EMV, etc.) is a major business driver impacting their POS upgrade and 37% believe the same about integration with a third-party delivery system. 55% of operators state features like Online POS for ordering/payment will drive their POS investments this year5.

Aside from POS investments, restaurants will continue prioritizing technology to improve staff productivity and overall operational efficiency. For operators, this means unlocking productivity through the digitization and automation of processes and ensure the effective roll-out and compliance with core operating procedures, public health and food safety protocols, brand standards, and other initiatives7.

Outdoor dining has become a lucrative on-premise dining alternative during the pandemic With hospitality technology innovations pushing hard to close the gaps in terms of changes to how restaurants can operate and serve diners, it’s clear people still value physically visiting restaurants to eat. It’s a cultural activity and 1 in 6 adults say restaurants are an essential part of their lifestyle1.

Outdoor dining and patio dining have proven to be reliable business drivers for restaurants in 2020. Restaurants are sure to benefit from offering this service in 2021 as well if they focus on making the outdoor dining experience comfortable and accommodating unseasonal weather.

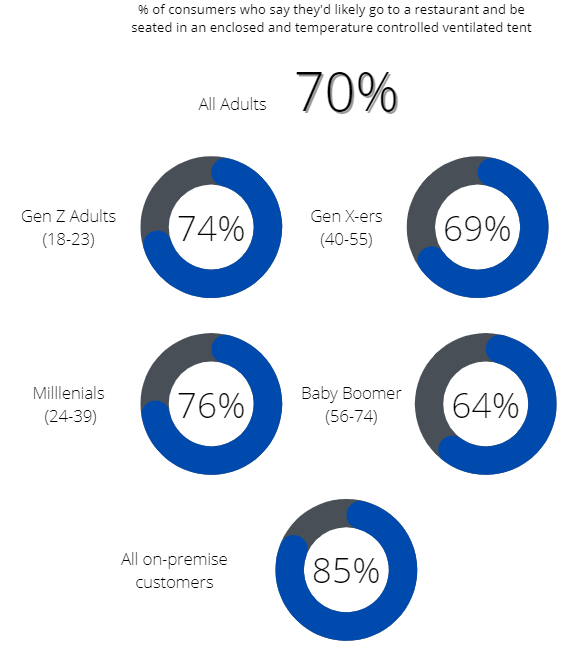

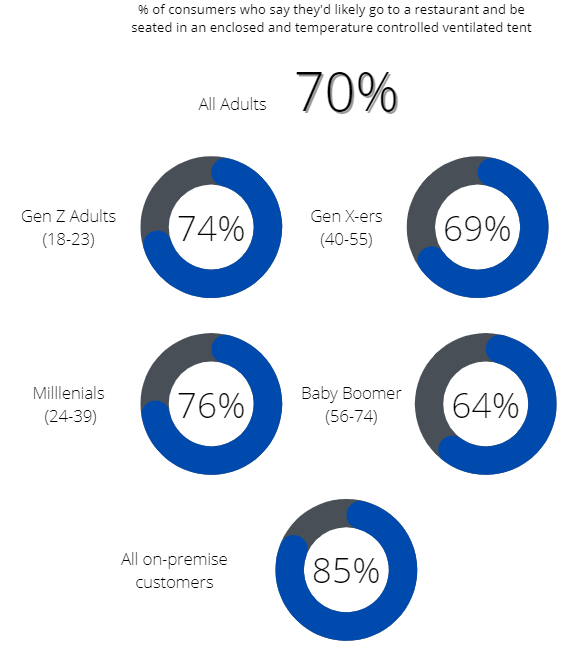

85% of customers that plan to eat at restaurants in the coming months will likely go to a restaurant to be seated outside in an enclosed temperature-controlled ventilated tent if social distancing can be maintained2. Like takeout and delivery, the main reason consumers will entertain the idea of outdoor dining this year considering the shelter-in-place restrictions is because of the associated level of COVID exposure risk it bares-which 30% of diners consider low3.

As operators gear up for patio season in a few months, considering how to plan operations to keep outdoor dining profitable will help keep this service viable in the off-season as well. Technology, specifically tableside ordering systems or mobile pos systems, plays a vital role in keeping patio business profitable in the following ways:

- Mobile POS terminals help servers focus on service – with tablets, servers can spend more time at the table to better explain the menu, act on impulse decisions, and even upsell items based on preferences indicated by diners.

- Mobile POS terminals allow for quicker patio table turn-overs - quicker table turn-overs means your restaurant will be able to accommodate more guests during regular operations—which is important when considering how popular patios are during the summer, especially if wait times are low and service is spot on.

- Restaurant loyalty programs are vital to retain customers and attract new customers in 2021

1 in 3 customers say restaurant loyalty programs influence their choice of where to eat out1. This means that offering restaurant loyalty programs like gift cards, for example, are more than just boxes to tick when it comes to creating a well-rounded guest experience.

Restaurant operators should look at them as powerful marketing tools, capable of attracting and retaining customers. 61% of Consumers think of promotions as a positive way to support restaurants with BOGO deals, free delivery, and loyalty points being among the most desired promotions2.

If you are an operator looking to build a loyalty program for your restaurant for the first time, the key to making them successful is:

- A simple loyalty program/restaurant promotion program will keep customers engaged - It should not take your guests more than 90 seconds to register for your loyalty program once they understand how they stand to benefit from it.

- Understand who your core customers are - identify who the patrons or regulars of your restaurant are. These are individuals that are already sold on what you have to offer and are most likely to take advantage of and appreciate loyalty benefits.

- Do not look to copy, be creative whenever possible - Do not be afraid to reward your guests in interesting ways, like exclusive access to off-menu items, charitable donations to a philanthropic cause, or discounts to local entertainment businesses.

The data referenced above has been sourced from the following reports and studies:

- NRA (2021). 2021 NRA State of the Industry Report. Link to PDF.

- Datassential (2021). Datassential One Table Consumer Insights Report. Link to PDF.

- Datassential (2021). Datassential Report 45 Waiting Game. Link to Article.

- Panasonic (2020). Panasonic Explores How the Pandemic has Transformed Food Services and Food Retail Industries. Link to Article.

- Hospitality Tech (2021). 2021 Pos Software Trends Report: Accelerating Innovation. Link to Article.

- NRA (2019). NRA – Harnessing Technology to Drive Off-Premises Sales. Link to Article.

- QSR (2021). Picturing the 2021 Restaurant Technology Landscape. Link to Article.

For the most part, due to COVID restrictions on dine-in last year, consumers accessed food from restaurants through off-premise dining options, like curbside delivery, online ordering, take out, and contactless delivery. In 2020, 53% of all adults said that purchasing food through take-out and delivery is essential to the way they live1.

As consumers have adapted to conditions, restaurant dining now is more about convenience, comfort, and most importantly low risk. Off-premise dining offers all these qualities for diners that consider restaurants a part of their lifestyle, especially the affordance of minimal risk. 44% of consumers consider getting carryout/takeout and food delivered to be not risky3.

Last year, 71% of operators spanning all restaurant segments stated that off-premise dining represented a larger share of their revenue than before COVID restrictions1. Based on that fact alone, operators can see the value in extending off-premise options to consumers, but they would be remiss in thinking that this trend is strictly bound to the pandemic. In 2019, off-premise sales represented nearly 60% of restaurant sales through all platforms6. The pandemic has only accelerated consumer comfort with using customer-facing restaurant technology like online apps, for example.

Regardless of whether you are an operator looking to introduce off-premise offerings on the back of its success in driving sales during COVID restrictions, or are looking to expand your current off-premise model to eventually scale business; focusing on the most essential offerings will ensure your business is well prepared to take advantage of the uptick in off-premise dining interest we will see throughout 2021 and beyond.

- QR code menus - 1 in 5 customers say the option of accessing the menu on their phone through a QR code would make them more likely to choose one restaurant over another during the next few months1.

- Contactless and Mobile Payments - Baby boomers and Gen Xs are much less likely to have tried contactless payment, but Millennials and Gen Zs will continue to use contactless payment options even once restrictions are lifted. 43% of millennials were already using contactless payment before the pandemic and 25% of Gen Zs tried it for the first-time during restrictions last year1.

- Online Ordering (native or third-party) - 50% of diners say that the availability of online ordering would influence their choice of one restaurant over another1. 79% of Baby boomers and 65% of Gen Xs are most likely to say they prefer to order directly through the restaurant for delivery. 44% of Gen Zs and 37% of millennials say that they will continue using third-party online ordering apps after restrictions lift2.

- Delivery and Takeout - 6 in 10 adults are more likely to get food delivered than before the outbreak, which is higher among millennials with 71% agreeing to this1.

As restrictions start to wane eventually, it’s reported that customers will use the following off-premise options more than they did pre-COVID2:

- Drive-throughs by 18%

- Call restaurants to place an order by 18%

- Use restaurant app to order by 18%

- Use third-party delivery apps by 12%

There is a growing pent-up demand among customers to dine-in at restaurants with many anticipating the day it becomes safe to do so. 67% of adults say they are not eating on the premises at a restaurant as much as they would like – with baby boomers (76%) and Gen Xs (65%) feeling the biggest pinch in this regard, followed by millennials (60%) and Gen Zs (56%)1.

Restaurants can expect diners to start returning to their dining rooms in the second half of 2021 as COVID vaccination rollouts start to ramp up. Consumers are excited to get back into dining rooms as soon as a new sense of normalcy is established, which for 40% of consumers means a vaccine is widely available3.

When preparing for restaurant re-opening for dine-in service, being knowledgeable about what customers expect is important to create a good impression and attract repeat business. Customers have come to expect restaurants to strictly adhere to pandemic safety protocols. 72% of customers rank safety over affordability and 67% rank safety over quality food2, which goes to show that safety reigns supreme now when considering meeting guest expectations and attracting business at your restaurants moving forward.

When it comes to what safety precautions are more important to diners it is safe to assume that more is better, but a few practices are seen less as a “good to have” and more of a requirement.

For example, 81% of diners now require operators to regularly/visibly wipe down tables, kiosks, other things people touch; 88% require other customers to maintain six feet or more of social distance; 45% require operators to enable mobile ordering/contactless payment. Other safety precautions worth considering are – getting rid of physical menus (60% of consumers support this) and eliminating communal seating (67% consumer support)3.

A part of keeping dine-in operations COVID safe requires planning floor operations in a way that limits server-customer interactions wherever possible without compromising the dining experience.

Having your staff equipped with the right kind of safety gear during service also falls under the purview of what diners expect in terms of safety. Close to 50% of consumers that dined at a restaurant during the pandemic were served by staff wearing gloves, 47% said servers wore masks when handing them food, and 33% were offered contactless payment options2.

Additionally, adding Mobile POS (Point of sales) technology like tablets can help restaurants limit the need for multiple staff members to use one fixed POS terminal. Mobile POS system solutions promote a more contactless dine-in service at restaurants, making them safer.

Restaurant operational trends to consider for 2021

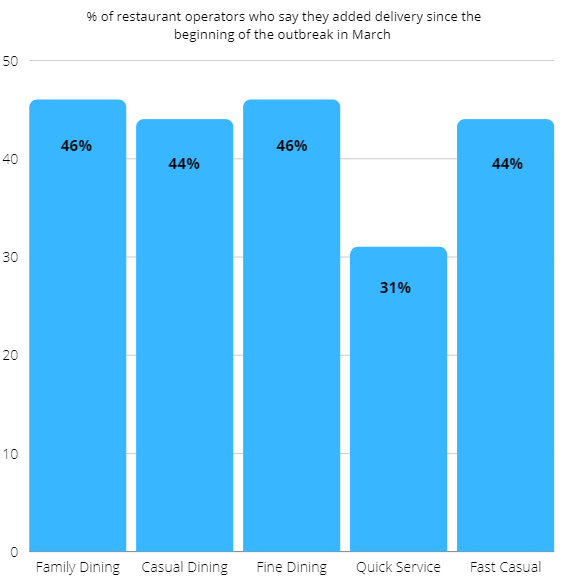

Restaurants were forced to adapt to an almost overnight shift away from on-premise dining and towards off-premise dining in March. 50% of fine dining, 50% of casual dining, and 46% of family dining restaurants say they devoted more resources to customer-facing technology like online or in-app ordering, mobile payment, and delivery management since March1.

Guided by the same changes to business operations and consumer dining behavior last year, Operators will look to accelerate key technology investments to optimize the business and improve restaurant reach locally in 2021. 71% of foodservice operators said the pandemic increased their sense of urgency to adopt transformational technologies, and believe digital transformation is very important to maintain business agility4.

When it comes to growing restaurant reach in 2021, off-premise technology investments in the form of POS upgrades and integrations that enable contactless, mobile, and online payment options like tap-to-pay and mobile wallet, and online ordering and delivery through third-party delivery apps, will continue to be a priority for operators in 2021.

68% of operators state enabling new payment options (e-wallet, tap-to-pay/EMV, etc.) is a major business driver impacting their POS upgrade and 37% believe the same about integration with a third-party delivery system. 55% of operators state features like Online POS for ordering/payment will drive their POS investments this year5.

Aside from POS investments, restaurants will continue prioritizing technology to improve staff productivity and overall operational efficiency. For operators, this means unlocking productivity through the digitization and automation of processes and ensure the effective roll-out and compliance with core operating procedures, public health and food safety protocols, brand standards, and other initiatives7.

With hospitality technology innovations pushing hard to close the gaps in terms of changes to how restaurants can operate and serve diners, it’s clear people still value physically visiting restaurants to eat. It’s a cultural activity and 1 in 6 adults say restaurants are an essential part of their lifestyle1.

Outdoor dining and patio dining have proven to be reliable business drivers for restaurants in 2020. Restaurants are sure to benefit from offering this service in 2021 as well if they focus on making the outdoor dining experience comfortable and accommodating unseasonal weather.

85% of customers that plan to eat at restaurants in the coming months will likely go to a restaurant to be seated outside in an enclosed temperature-controlled ventilated tent if social distancing can be maintained2. Like takeout and delivery, the main reason consumers will entertain the idea of outdoor dining this year considering the shelter-in-place restrictions is because of the associated level of COVID exposure risk it bares-which 30% of diners consider low3.

As operators gear up for patio season in a few months, considering how to plan operations to keep outdoor dining profitable will help keep this service viable in the off-season as well. Technology, specifically tableside ordering systems or mobile pos systems, plays a vital role in keeping patio business profitable in the following ways:

- Mobile POS terminals help servers focus on service – with tablets, servers can spend more time at the table to better explain the menu, act on impulse decisions, and even upsell items based on preferences indicated by diners.

- Mobile POS terminals allow for quicker patio table turn-overs - quicker table turn-overs means your restaurant will be able to accommodate more guests during regular operations—which is important when considering how popular patios are during the summer, especially if wait times are low and service is spot on.

1 in 3 customers say restaurant loyalty programs influence their choice of where to eat out1. This means that offering restaurant loyalty programs like gift cards, for example, are more than just boxes to tick when it comes to creating a well-rounded guest experience.

Restaurant operators should look at them as powerful marketing tools, capable of attracting and retaining customers. 61% of Consumers think of promotions as a positive way to support restaurants with BOGO deals, free delivery, and loyalty points being among the most desired promotions2.

If you are an operator looking to build a loyalty program for your restaurant for the first time, the key to making them successful is:

- A simple loyalty program/restaurant promotion program will keep customers engaged - It should not take your guests more than 90 seconds to register for your loyalty program once they understand how they stand to benefit from it.

- Understand who your core customers are - identify who the patrons or regulars of your restaurant are. These are individuals that are already sold on what you have to offer and are most likely to take advantage of and appreciate loyalty benefits.

- Do not look to copy, be creative whenever possible - Do not be afraid to reward your guests in interesting ways, like exclusive access to off-menu items, charitable donations to a philanthropic cause, or discounts to local entertainment businesses.

- NRA (2021). 2021 NRA State of the Industry Report. Link to PDF.

- Datassential (2021). Datassential One Table Consumer Insights Report. Link to PDF.

- Datassential (2021). Datassential Report 45 Waiting Game. Link to Article.

- Panasonic (2020). Panasonic Explores How the Pandemic has Transformed Food Services and Food Retail Industries. Link to Article.

- Hospitality Tech (2021). 2021 Pos Software Trends Report: Accelerating Innovation. Link to Article.

- NRA (2019). NRA – Harnessing Technology to Drive Off-Premises Sales. Link to Article.

- QSR (2021). Picturing the 2021 Restaurant Technology Landscape. Link to Article.

The data referenced above has been sourced from the following reports and studies: