It’s no secret restaurants shifted towards online ordering and delivery models. The boom was bound to happen, but the pandemic kicked things into high gear. Prior to the pandemic, delivery had been growing 20% year over year, and big players like Grubhub, Uber Eats and SkipTheDishes had been steadily disrupting the market.

However, it’s not the first time third parties shifted the customer acquisition landscape for hospitality. Throughout the 2010s, Online Travel Agencies (OTA) commissions grew 50% from 2011-2015. Hotel revenues on the other hand, grew 25%. As the decade continued, industry growth funneled to OTAs, and hotels had to pivot. Sound familiar? There’s parallels to the experience of restaurants today, and capitalizing on opportunities starts with an understanding of OTAs in the hotel industry.

Hotels have seen third party customer acquisition disruption before

A report from Kalari Labs shows how from 2014 – 2016 OTA share of room nights had grown 28%, while direct bookings only grew 9%. Like third party delivery services today, commissions from OTAs were a contentious issue for hotel operators. OTA commission rates were growing at three times the rate of guest-paid revenue and hotel operators were unable to benefit from the growth in market demand as a result.

Ultimately, guest-paid revenue grew 4.6%, while net revenue only grew 4%, and that gap widened further over time. As commissions for OTAs grew 45% from 2015-2018, hotel operators were faced with a wall restauranteurs are now hitting. Hotel operators knew direct bookings were 12.5% more profitable than OTA bookings. They just had to put the right programs in place to capitalize, and they did.

Taking control of the guest relationship with loyalty programs

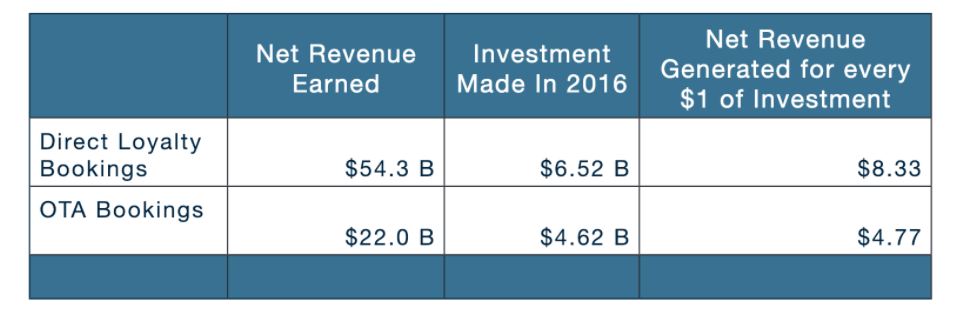

Hotel operators knew regaining control of the guest relationship was key to new or reoccurring revenue opportunities, such as room upsells and bundled rates. It also enabled operators to stop paying for bookings from OTAs. So, they invested in loyalty programs and direct booking channels. Once that hit the mainstream in 2016, loyalty program enrolment grew at two to five times the rate prior to direct booking channels being available. Hotel operators found that the ROI on direct loyalty programs was almost double that of OTA related bookings.

There is a similar disruption happening to restaurants right now

An easy, but costly assumption is that the third party delivery boom is pandemic driven. It’s not. Digital ordering and delivery programs had been growing 300% faster than dine-in since 2014. When the pandemic hit, delivery hit a new level, with online ordering increasing 3958% in large suburbs. There’s no doubt the pandemic accelerated adoption, but this trend was coming and is here to stay.

Like the growth of OTA revenue and commissions in the hotel industry, third party delivery services have exploded. In March alone, Grubhub increased revenues by 21% while restaurants were struggling to stay afloat. Restaurateurs are calling out third party delivery services and high commission fees ranging from 30-50%, as a huge issue in their profitability from these channels. How can restauranteurs take control of the guest relationship like hotel operators did in 2016?

Control the relationship with savvy restaurant guests

It’s important to understand restaurant diners are savvy and informed consumers. They are not as loyal to delivery apps as they used to be. In 2018, 75% of Grubhub users wouldn’t use any other apps, while in 2020 it’s dropped to 53%. 70% of diners also say they would prefer ordering direct from restaurants to support them. Data on members of loyalty programs also show they spend 67% more, much like hotel loyalty members. Ultimately, there’s an opportunity to engage with customers that have been coming through a delivery platform, and capture increased profit.

Order profitability in a loyalty-based program vs. third party service

The table below shows how two very similar orders can be very different to the bottom line. By implementing online ordering and providing loyalty incentives for upsells, even in an environment dominated by the third-party providers, operators can grow their order size and reduce the costs associated with commissions while maintaining the relationship with the guests.

| Order Comparison | 3PD Order & Delivery | Online Order with 3PD & Loyalty | ||

|---|---|---|---|---|

| Clubhouse Sandwich | $14.95 | Clubhouse Sandwich | $14.95 | |

| Chicken Tenders | $11.95 | Chicken Tenders | $11.95 | |

| Mozza Sticks | $11.95 | Mozza Sticks | $11.95 | |

| 10% Loyalty Discount Wine | Bottle House White | $17.95 | ||

| Subtotal | $38.85 | $56.80 | ||

| Order Commission 15% | -$5.83 | $0 | ||

| Delivery Commission 10% | -$3.90 | $-5.60 | ||

| Total Order Value | $29.12 | $51.20 |

These capabilities exist today

At Squirrel, we’ve built a flexible restaurant point of sale system to help restaurants capitalize on new opportunities. With CRM functionality and integrations with our partner DataCandy , your restaurant can start taking control of the customer relationship now.

Learn more about how loyalty benefit your business and how Squirrel can support your restaurant.