The Impact of Third-Party Delivery Commissions & How the Marketplaces are Changing

In this article, we’re going to look at the typical structure of third-party delivery (3PD) commissions, how the industry providers are changing their business model, and its impact on restaurants.

The restaurant industry operates on relatively small margins compared to other comparable sectors such as retail, and any additional costs can be challenging to manage. Over the past year, many restaurants and other hospitality businesses have turned to third-party delivery marketplaces to keep revenue streams flowing.

Restaurant Margins are Tight

Before we delve into the various 3PD solutions and costs, let’s look at a hypothetical restaurant meal and the multiple inputs that go into it:

(Image from Wolf Down Medium Blog)

This is probably pretty familiar to most restaurant operators. So what happens when we add a 3PD provider like Uber Eats – 15% order commission and 15% delivery commission – to the mix?

The restaurant only has two choices with this fee structure, increase prices, or lose money on each order. An $11 Doner must become a $14 Doner if the restaurant hopes to have any profit. This is a simple example, using Uber Eats published commission rates and not amortizing the initial account fee ($350).

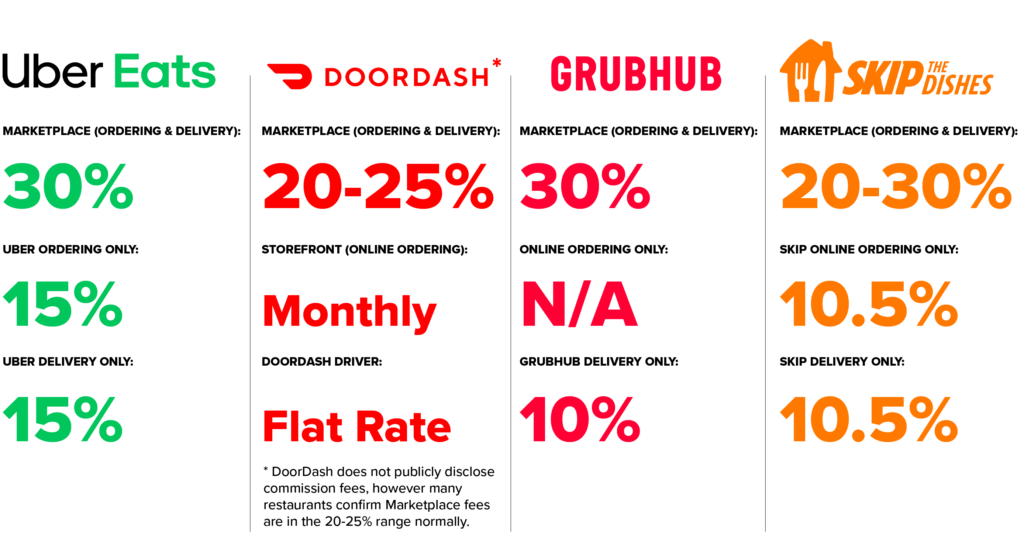

3PD Fees

NOTE: These commission rates are a baseline, larger restaurant groups and multi-units often are able to negotiate lower rates due to volume.

Legislative Caps & Business Models

In some regions, legislation is in place, particularly if restrictions on dining rooms exist. In Canada, the Province of British Columbia instituted a cap on fees to the restaurant at 15%. Other jurisdictions across North America are also introducing caps, either at the State or Municipal level. Cities such as San Francisco and Chicago are among Municipal Governments taking measures. Importantly, many of these regulations are emergency orders or similar and may expire in the future.

The providers are also looking at ways to keep revenue streams operational. In some cases, this is directly tied to commission caps; Skip the Dishes responded to the cap in BC with a $0.99 BC Tax. Other platforms are expanding their offering structure. In addition to the familiar DoorDash Marketplace, DoorDash also offers separate online ordering (DoorDash Storefront) and white label driver solutions (DoorDash Drive) with non-commission pricing structures and experimenting with guest pricing changes such as subscription.

Delivery is extremely popular with guests, and first-party delivery is not achievable for many businesses. It seems that competitive pressure, guest behavior, and regulation point to the desire for reasonable and sustainable commissions and fees.

However, fees aren’t the only – or possibly even the highest – costs involved

We’ve written previously about the efficiency benefits of POS integration with 3PD, equally as beneficial is owning the relationship between your business and your guests. By planning a comprehensive digital strategy – a seamless online ordering, takeout, delivery ecosystem – you can present an online experience with the same control you do in your dining room.

Restaurants of all scale, scope, and concept have been able to utilize some of the solutions Squirrel and its preferred partners offer to launch or enhance their digital service strategy.

Join us for a webinar on Thursday, April 1st, where we’ll be looking at what 3PD integration with your POS can look like and addressing topics like order flow, menu management and pricing, and expediting and fulfillment.